A recent report from the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) found a major increase in check fraud. According to the agency, banks reported more than 350,000 instances of check fraud in 2021, representing a 23% increase in check fraud from the previous year; and that number rose nearly twofold to more than 680,000 in 2022. That is a troubling trend affecting both individuals and businesses whose checks and banking data are altered or forged by criminals. While many individuals are targeted by check fraud for hundreds or perhaps thousands of dollars, businesses are susceptible to check and payment fraud for larger sums.

A recent report from the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) found a major increase in check fraud. According to the agency, banks reported more than 350,000 instances of check fraud in 2021, representing a 23% increase in check fraud from the previous year; and that number rose nearly twofold to more than 680,000 in 2022. That is a troubling trend affecting both individuals and businesses whose checks and banking data are altered or forged by criminals. While many individuals are targeted by check fraud for hundreds or perhaps thousands of dollars, businesses are susceptible to check and payment fraud for larger sums.

Because they often have more money and conduct more transactions with larger networks of customers and trading partners, it is easier for criminals to hit business organizations with bogus charges and to pass fraudulent payments through without raising suspicions. According to the 2022 AFP® Payments Fraud and Control Report, underwritten by J.P. Morgan, 71% of businesses reported being victimized by some form of payments fraud in 2021, and for businesses with annual revenue of more than $1 billion, that number was 77%. The five top payment methods used to defraud businesses include:

- Checks (66%)

- ACH debits (37%)

- Wire transfers (32%)

- Corporate credit cards (26%)

- ACH credits (24%)

The FBI says criminals took in $18.7 billion through check fraud in 2021, but the actual costs to the economy are much higher. Efforts to detect, prevent, and respond to financial fraud have a multiplying effect on banks. According to LexisNexis Risk Solutions, “Every $1 lost to fraud now costs U.S. financial services firms $4.23.”

Positive Pay is a Simple Tool for Fighting Financial Fraud

One simple way for businesses to address the prevalence of check fraud is the use of Positive Pay. Investopedia describes Positive Pay as “an automated cash-management service used by financial institutions to deter check fraud. Banks use positive pay to match checks issued by companies with those it presents for payment. Checks that are considered suspicious are sent back to the issuer for examination.”

One simple way for businesses to address the prevalence of check fraud is the use of Positive Pay. Investopedia describes Positive Pay as “an automated cash-management service used by financial institutions to deter check fraud. Banks use positive pay to match checks issued by companies with those it presents for payment. Checks that are considered suspicious are sent back to the issuer for examination.”

Working with their bank or financial institution, organizations that use Positive Pay send their bank a daily report of every check issued. The bank then reconciles three primary elements of each check presented with the information on the report, including date, check number, and dollar amount. A check’s payee can also be examined as a part of the process.

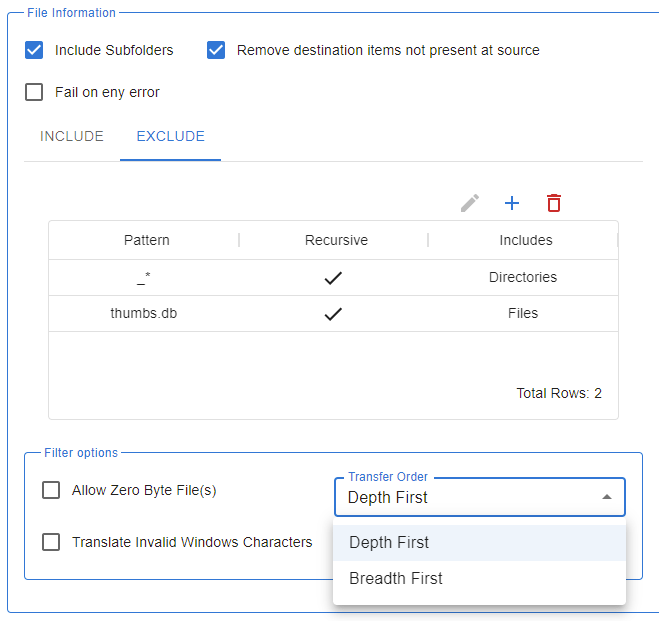

Banks that offer Positive Pay to their customers typically support one of two means for accepting information: online portals through which customers manually enter Positive Pay records, or direct file transfers using the secure file transfer protocol (SFTP). Organizations that opt for file sharing through SFTP can gain the confidence of knowing their processes are accurate and reliable when those transfers are automated. Coviant Software’s Diplomat MFT makes automated Positive Pay reporting easy, and because Diplomat MFT also automates file encryption using OpenPGP, the chance of human error is all but eliminated, keeping the risk of a data breach low and thus keeping your name out of the news.

Diplomat MFT is a Simple Tool for Automating Positive Pay

An additional benefit to automating check issue and exception report file delivery with Diplomat MFT is the time and money businesses can save. In addition to avoiding financial losses associated with check fraud. Secure financial data transfers can also help to avoid losses that come in the event of a data breach which, according to the Ponemon Institute/IBM Cost of a Data Breach Report 2022, cost financial institutions $5.97M per event. Furthermore, employees that aren’t spending time on manual transfers can focus on more valuable work. And with full auditing, data archiving, and delivery notifications you will always stay informed, secure, and compliant with data security and privacy regulations.

When using Diplomat MFT to secure and automate Positive Pay file transfers you get:

- Automated security through SFTP, SSH Client Key Authentication, and OpenPGP encryption.

- Automated delivery at whatever frequency you require, whether once-a-day transfer, periodically throughout the day, or on-demand. And the Diplomat MFT scheduler supports calendar exclusions so files are not transferred on bank holidays.

- Automated workflow capture and notifications, with full audit trails, file archiving, and notifications over email, Slack, or Teams.

Finally, with Coviant Software, you won’t suffer the financial costs associated with purchasing complex products from larger vendors. Diplomat MFT is ethically priced and recognized as the best value in managed file transfer without sacrificing features or the scale your organization requires. And Diplomat MFT is backed by the highest rated customer support in the industry. In short, Diplomat MFT is the perfect tool to automate and secure Positive Pay transactions. Contact us today for more information or a free demo.